One of the benefits of robots for warehouses and factories is that they can add capabilities without requiring new infrastructure. However, robotics developers should still be aware of the extent of collaboration between humans and robots. For instance, inVia Robotics Inc. uses sonar and controlled speeds to make its Picker mobile robots safe.

“Automation has been with us for many years, but what’s changing is robots’ ability to adapt to the environment, lowering investment costs,” said Lior Elazary, CEO of Westlake Village, Calif.-based inVia. “In the past, robots were on rails, and it cost a lot of money. It was hard to justify — if the cost of automation is too high, people can move boxes around.”

“We used to have shuttle systems in warehouses, but it would take millions of dollars and several years to set up,” he told The Robot Report. “We’re working on self-driving cars rather than laying railroad tracks. Now, it’s very cost-effective. We can provide efficiency without having to alter existing production lines.”

Elazary credited the accelerating pace of e-commerce order fulfillment with driving demand for more warehouse automation. Still, he said, both mobile robotics providers and prospective users should understand different approaches to increasing productivity.

Distinguishing capabilities

“When we started inVia, we looked at various warehouses to see where robots would be the best fit,” Elazary recalled. “We looked at workflows, such as goods-to-person, where a person picks items that go to packaging.”

“There are a lot of systems to augment that, such as Kiva [Amazon Robotics] and Fetch, where the items come to the worker,” he said. “In addition, there are entrants such as Locus Robotics and 6 River Systems where a person does the picking with an autonomous cart.”

“When we looked at that workflow, we realized that it was still difficult and expensive for robots to grasp items,” explained Elazary. “It was also still very infrastructure-intensive. You needed mirrored floors for Kiva and low shelves. Customers need full goods-to-person automation that can work with any type of shelf and corrugated cardboard or plastic totes.”

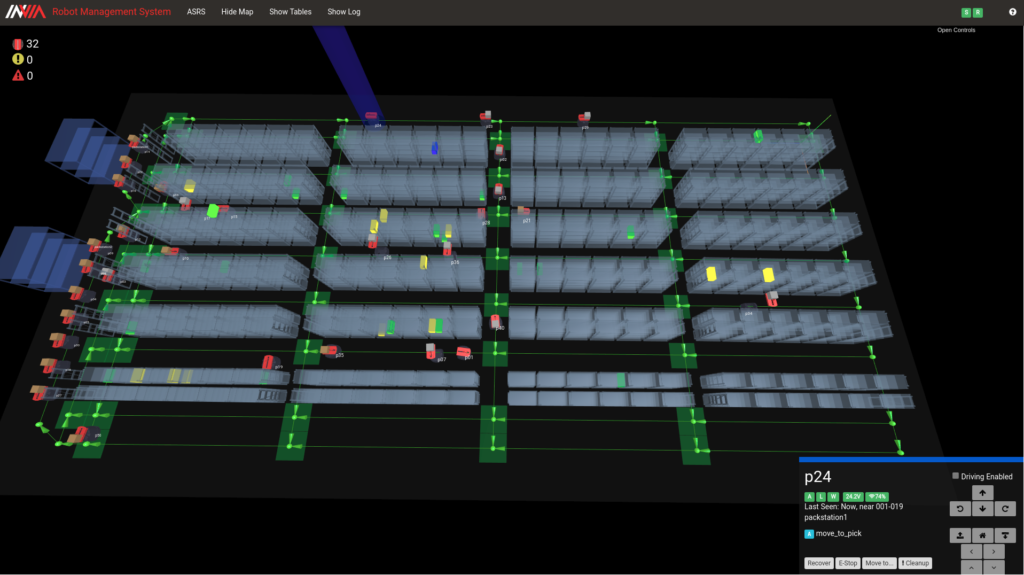

“We designed an AS/RS [automated storage and retrieval system] robot that could handle 40 lb. of weight, was small enough to go through existing aisles, and could grab totes and go to a location,” he said. “Once we designed the robot, we had to design a management system to handle fleets of 100 robots or more per deployment. Then, high efficiency of moving loads, depending on the environment, could be done almost on a realtime basis.”

A year after its initial deployment, Rakuten Super Logistics expanded its use of Picker mobile robots. Source: inVia Robotics

Relieving the pain of replenishment

“On top of that, the robots can handle returns, replenishment, and cycle counting,” Elazary said. “It could be done autonomously by weighing the tote or sending it to a person to count the items, which could take a long time. Picking and replenishment is a real pain point.”

“On the replacement side, customers need items put back in the right place, and they need people familiar with WMS [warehouse management systems], but with lower-cost labor doing it and high turnover, there are more mistakes,” he added. “Eliminating replenishment mistakes is a huge factor, so the challenge was to provide a sticker with a single SKU [stock-keeping unit] so that users don’t have a lot of choices.”

inVia’s system makes SKU scanning straightforward. Source: inVia Robotics

“You want people to scan the right item and put it in the right tote,” said Elazary. “Traditional automation can double productivity but is still expensive. Our goods-to-person system can get people working at 5x — that’s our biggest differentiator.”

inVia brings automation within reach

More than 4 million commercial robots will be installed in over 50,000 warehouses by 2025, compared with only 4,000 warehouses in 2018, predicts ABI Research.

“Heavy, expensive goods-to-person systems can put automation out of reach for everyone but the Walmarts and Targets of the world,” Elazary claimed. “We can provide the same throughput and levels of efficiency and enable smaller and midsize customers to implement robotics without as much overhead.”

Such small and midsize enterprises can’t go through the same amount of effort to deploy 20 robots as large companies with 2,000 robots, but they’re still looking for a better way of doing things and getting returns on their investment, he said, adding that “3PLs [third-party logistics] are under pressure because nobody wants to pay for shipping.”

Rakuten Super Logistics announced this spring that it is expanding its deployment of inVia’s Picker robots after seeing a 50% to 70% increase in throughput, as well as improvements in employee morale.

“Midsize customers like Rakuten require high throughput, but their costs have to be very low,” he said. “To achieve that, they have to deploy many robots that can handle 5,000 SKUs. There are lots of different shelves, lots of movement. It’s a small amount compared with 1,000 Kiva systems per Amazon warehouse.”

“Our scissor lift can reach from 20 ft. up, so that we can pick tall items,” Elazary said. “It’s really a range. The robot may not reach the bottom shelves, but companies that sell food are not allowed to put stuff on the bottom.”

Another example is Tobi.com LLC, an online fashion retailer that used inVia’s cloud-based robotics as a service (RaaS) in its warehouse in Reno, Nev. “It needed to move things faster, and its SKUs are constantly changing,” Elazary said.

inVia’s cloud-based Robot Management System is interoperable with WMSes. Source: inVia Robotics

Integrating management and starting a second shift

“We’re not only disrupting warehouses, but we’re also disrupting the way integration is done,” asserted Elazary. “We had to deal with different WMSes, and we integrate them into our system with their APIs [application programming interfaces]. Then each WMS translates automatically into our patented system, allowing for custom workflows and moving items to different locations.”

“We’ve reduced integration time from six to seven months to one month,” he said. “It’s not just about throughputs; it’s about extracting orders and handling all their workflows. We’re becoming a pipeline into WMSes, and our system should be able to handle picking in any type of warehouse.”

Last summer, inVia raised $20 million in Series B funding to expand commercial deployments of Picker and double its employee headcount.

“The next iteration is really getting to a point where there are multiple shifts of robots in the warehouse,” Elazary said. “We’re experimenting with having robots run more autonomously at night. Customers are getting orders constantly, and we’re working with partners to have robot arms pick some items and prepare complete orders.”

Filed Under: Warehouse automation, The Robot Report, Springs • wave springs, Robotics • robotic grippers • end effectors

Tell Us What You Think!