In its wake, the COVID pandemic left lingering supply-chain issues that are still affecting manufacturing and other automated industries. Now some slowdowns at least have cleared.

By Lisa Eitel | Executive editor

The last few years’ supply-chain issues have featured container ships waiting weeks for cargo unloading; empty shelves at stores; year-long waits for appliances; per-customer quantity limits on basic necessities; beleaguered online vendors struggling to maintain inventory; baby-formula fiascos; and various other back-ordered (and unavailable) parts and subcomponents in all industries. Today, shipments of goods have largely recovered, though data indicates the global supply chain in some markets continues to falter.

In fact, recoveries in shipping times and inventories may be due to the cooling effects of inflation and its discouragement of spending. Some predict the economic weakness of early 2023 will allow supply chains to recover and fully stabilize by 2024. But making business ventures even more challenging are the labor-shortage issues that have accompanied those on the supply side during COVID.

To be clear, most industry experts we surveyed for the 2023 Design World Trends issue don’t expect a fully normal supply chain or labor market for another year. Read on for the details.

Sergii Sverdielov • Dreamstime

Meet the experts

James Gallant | Director of operations • ISL Products International Ltd.

Boaz Eidelberg | CTO • SAAR Inc.

Matt Mowry | Product manager — drylin linear bearings • igus Inc.

Adam Gluck | Founder & CEO • Copia Automation

Kelly Walden | V.P. of manufacturing • Bishop-Wisecarver Corp.

Tim Sharkey | Director of market management for electric automation • Festo

Chris Gumas | Director of marketing • Ruland Manufacturing

Pamela Kan | President and owner • Bishop-Wisecarver Corp.

Jeremy Miller | President • Motion Plus

Patrick Varley | Product marketing manager — mechatronics • Mitsubishi Electric Automation

Chris Gottlieb | Director — Drives and controls • Kollmorgen

Christine Hansen | Director of product marketing manufacturing • Epicor

Eric Rice | Product market manager — Electric Automation • Festo

Tom Schroeder | Executive V.P. • PBC Linear

Dave Walden | Applications engineer • PBC Linear

Nathan Andaya | Director — Techline strategic business unit • LINAK U.S.

David Sandys | Director of technical marketing • Digi-Key Electronics

Andy Zaske | V.P. of sales and marketing • Tolomatic

Since the disruptions of COVID, which supply-chain issues have you seen persist or evolve?

Gallant: Raw material leadtimes are still longest, especially coming from Asia. However, we’ve seen significant improvement in logistics. Transit times have been reduced both internationally and domestically. We work with our customers very closely to plan out production timelines to ensure we factor in all manufacturing and logistical leadtimes.

Mowry: Most major supply-chain issues that peaked during COVID have improved. Notably, the availability of aluminum extrusions, which had severe leadtimes over the past couple of years, has recovered.

K. Walden: We’ve seen persistently longer leadtimes on raw materials — particularly for stainless steel and electronics items. So, we’ve implemented elevated stock holdings in strategic areas and established new suppliers and supply-chain options. We’ve also looked to re-engineer materials or production processes for leadtime reductions.

Gottlieb: We’ve seen supply-chain issues across the supply base and transportation sectors. It only takes one part to create a shortage on a final assembly, and we’ve experienced various issues from our vendors in market sectors mentioned in the news — semiconductors, materials — and those affected by transportation bottlenecks, cybercrime, and natural disasters. Kollmorgen works aggressively to keep materials flowing through broker purchases and engineering redesigns.

Miller: Supply-chain issues have probably been the single most predominant challenge for our suppliers and customers over the past two to three years. Automation manufacturers’ leadtimes have skyrocketed industrywide — forcing customers to seek alternative solutions and, in some cases, make concessions where they normally would not.

Manufacturers also face obscene leadtimes for component parts and shortages — driving them to either work through brokerage firms (which drives up cost) or design in substitute components, often adding cost and complexity to the products they sell. Products with integrated microchips appear to be hardest hit in this area.

As a distributor and manufacturer of many motion control products, one way Motion Plus has worked to mitigate these challenges is to put extensive amounts of finished-goods inventory on the shelf. We’ve done so on products like stages, motors, drives, and controllers, which are often highly configurable. There’s some risk in doing this, as it’s nearly impossible to cover every configuration option for every application/customer. However, we’ve found the 80/20 rule to be applicable here. If we stock the most commonly used options, they can usually work for most applications, and often customers are willing to accept a slight deviation to their exact part number if it means getting a product in days instead of weeks or even months.

T. Schroeder: In most sectors, the supply chain is starting to normalize. Suppliers have been catching up on backlogs, costs are starting to come down, and ocean freight costs have decreased. Electronics components are still lagging behind the rest of the sectors … and that’s causing complications and production delays. Companies are starting to transition back to a just-in-time inventory and reduce built-up inventory that was created during surging demands and supply chain uncertainty from COVID and recession worries.

Supplier diversification and strong supplier relationships have been critical … and will be critical through the next few years.

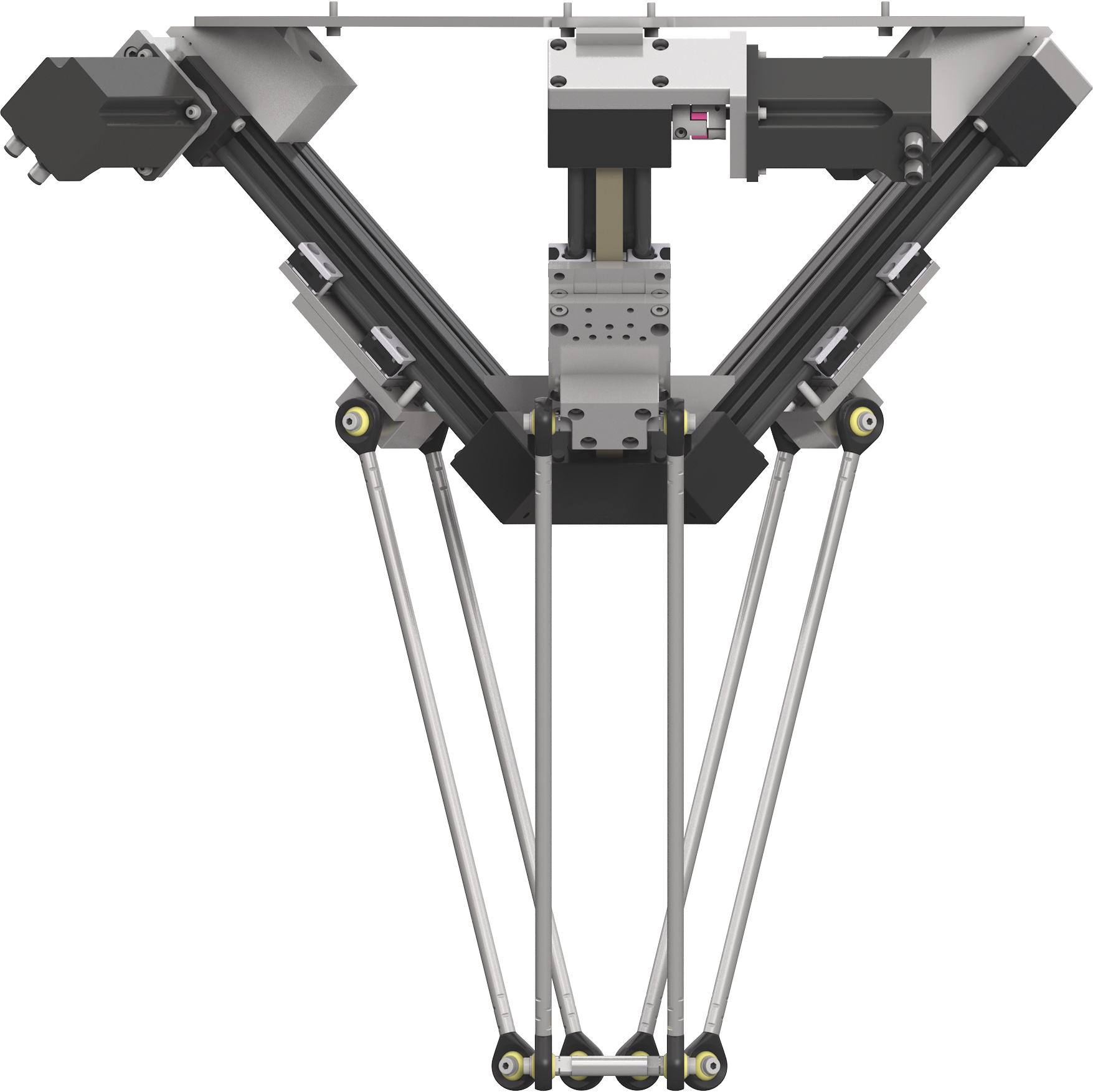

Low-Cost Automation (LCA) robots have a rapid return on investment for endusers who aim to automate simple processes. Image: igus

Varley: Many of our customers are still experiencing periodic component delivery issues. We’ve been working internally to increase production and meet the delivery dates that we provide to our customers.

Eidelberg: SAAR Inc. is active in exoskeleton product development and is experiencing no supply-chain issues.

Sandys: With challenges due to supply chain shortages over the past three years, innovation stalled and temporarily took a backseat. However, with the worst behind us, we’re now seeing innovation escalate and even leapfrog where it would’ve been had the pandemic not happened. Now, the pace of innovation is on an unprecedented trajectory as new technologies are available to make designing products easier. In addition, the availability of parts is again expanding — along with the maker community’s sheer enthusiasm and excitement to innovate. These makers (and the ecosystem around them) are priming an innovation renaissance.

Gumas: Ruland has been fortunate that we’ve had no supply-chain disruptions. Our supply chain is primarily North American, which has limited the direct impact of availability — but not price.

In fact, we’ve always viewed our supply chain as critical to our ability to have industry-leading leadtimes and on-time delivery. The JIT model that many manufacturers have successfully implemented throughout the years was too risky for us in the event of an unforeseen shortage. Our competency is the ability to quickly manufacture products, not manage a complex global supply-chain network.

How are you addressing any lingering supply-chain and labor problems?

Andaya: Procuring electronic components for products has been a struggle. Domestic labor shortages have also made maintaining experienced folks on the production line challenging. We’re addressing the supply-chain issues by sourcing some components from the open market and purchasing them well in advance. So, we’ve increased labor rates, and we’re in the process of adding a new production line with cobots.

Zaske: The last three years have been very dynamic for various reasons. 2022 was challenging with long supplier leadtimes, a tight labor market, inflationary pricing, and delayed deliveries. We’ve pulled a number of levers to address these issues, but one of the most important was our initiative to attract and retain employees. We organized a special group that helped us make several significant changes in a short period to stabilize and grow our workforce.

Andaya: Electric linear actuators and electric linear columns have been key to our growth in several markets. Because these actuators are intelligent, they can work on equipment compatible with collaborative robots (cobots) and logistics and warehousing equipment to reduce the labor needed for a given task. In fact, our products excel at assuming the mundane labor of operations involving repetitive motions.

Is your company supplying robotics to address the manufacturing industry’s skilled labor shortage?

Mowry: We’re working hard to promote our line of linear actuators and Low-Cost Automation (LCA) robots that help customers realize a rapid return on their investment … typically within six months. igus LCA robots include gantries, delta robots, articulated arms, and low-cost master control systems. Because we’re also a linear component manufacturer, we supply many parts that give engineers the flexibility to build their own low-cost robotic solutions.

Eidelberg: Our company focuses on reinforcement learning motion control technology of exoskeletons. We believe that reinforcement learning is the future of autonomous system control. It optimizes the real-time machine’s decision-making process in unpredictable environments to maximize intended performance.

Exoskeletons and humanoids are examples of such autonomous machines. Both are expected to increase the mobility and functionality of industrial employees as well as address a potential labor shortage. Tesla and Hyundai, for example, have spent billions of dollars developing reinforcement learning motion control technology for humanoid and other robots expected to support their manufacturing needs.

Varley: We’re seeing a strong increase in the amount of interest in our robotic and automation products. By automating processes, our customers are able to maintain steady production regardless of the impacts of the labor shortage.

Gumas: Ruland products are commonly used on robots, conveyors, and machine tools that help the modern manufacturer automate to solve skilled-labor shortages. For example, autonomous mobile robots or AMRs use couplings for the drive system; shaft collars to keep internal components in place; and vibration-isolation mounts to damp vibration during operation. These robots move throughout factories to transit parts, materials, and consumables — increasing the efficiency of current employees who no longer have to manually move these items throughout the day. Ruland products are critical in such systems to address acute labor shortages and limit the long-term need for new employees.

What other automation technologies are helping address skilled labor shortages?

Kan: COVID hastened the pace at which companies aim to automate their processes. Projects that were perhaps considered five years out are (all of a sudden) a top priority. Our technologies help solve the toughest automation challenges in contaminated and extreme environments. We’re also proud to automate dangerous workplace settings and reduce worker exposure to environments that may not be healthiest for direct human interaction.

Rice: Our Regional Service Center in Mason, Ohio, has a customer-solutions department. This unit is experiencing exponential growth for its custom assembly and test-before-ship services. Festo’s internal systems and economies of scale make these custom solutions practical, allowing OEMs to embed unique assemblies in their machines. These designs include custom air-preparation units, valve manifolds, and Cartesian systems. There’s no industry or system complexity for which we don’t work with its customers. Our efforts revolve around motion automation.

Gluck: Copia Automation helps operations leverage in-house expertise to quickly onboard new hires. With Copia’s ability to show PLC code directly in a web browser, checking a colleague’s work is convenient and easy. New hires better understand the codebase, track changes, and contribute to the project without disrupting the work of other developers. Further, senior engineers can continuously review the new hire’s changes and directly comment on any concerns about rungs, blocks, and tags. Skills increase as senior engineers share their knowledge.

Copia can display code in a web browser to help managers and new hires more efficiently communicate about a given codebase. Visit www.copia.io for more information.

Andaya: In addition to helping our customers reduce the need for manufacturing labor, we’re able to make the work environment more attractive for existing laborers. We do this by using electric linear columns to make workstations ergonomic, which increases employee satisfaction and reduces workplace injuries.

K. Walden: Our company offers a broad range of motion solutions that are integral to automation. These include linear and curvilinear components, actuators, and even seventh-axis designs and more complex systems. Working in-house to automate our own production processes — and with our customers to solve their automation challenges — we’ve developed some great solutions.

Sharkey: The pandemic hastened demand for automated sample handling and fluid-dispensing systems in laboratory devices. Festo industrial-automation-based XY tables and Cartesian gantries offer economies of scale and robustness that lab device OEM systems simply cannot rival. Outsourcing lab device mechatronics enables the OEMs to concentrate on science — their value add — while relying on suppliers such as Festo to assemble, test, and deliver drop-in solutions.

In 2018, Festo opened its LifeTech Technology Engineering Center in greater Boston. This center provides customers with consultative engineering services for their new product development and Festo with new product development in laboratory automation and microfluidics. During the pandemic, the team at the Festo Technology Engineering Center worked tirelessly with customers to meet expanding demand, and the center has grown its staff and capabilities accordingly.

Festo industrial-automation-based XY tables and Cartesian gantries offer economies of scale and robustness unmatched by lab-device OEM systems. Image courtesy of Festo.

Hansen: Adopting software solutions such as Epicor Kinetic (our manufacturing-specific solution) can bolster businesses’ competitive edge when hiring. As skill gaps and labor shortages continue, positioning a business as a forward-thinking organization — with tools in place to make potential new hires’ jobs easier — can be a deciding factor. Today’s high-value candidates are looking for places to work that are rich with new and intuitive technology. Enterprise software implementation combined with automation are the technology building blocks manufacturers can employ to improve bottom lines while operating with a slimmer workforce.

Gottlieb: Kollmorgen’s motion control expertise is central to helping with the labor shortage. Our products are truly the brains, heart, and muscle of making global manufacturing safer and more efficient. Products such as the SafeMotion and Safety2G with Kollmorgen’s AKD2G servo drives (which follow IEC 61508) let production operators safely interact live with the machine under controlled and statistically reasonable conditions. In conjunction with a risk assessment and development from the machine builder, speed can be monitored with functions like SafeSpeed and SafePosition, while movement — or lack thereof under a SafeStop function set — is monitored via Safe Brake Control, Safe Brake Test, Safe Stop 1, and Safe Dynamic Brake. Resident safety in the servo drive allows for speed in monitoring and actuation at servo update-rate loop times.

Setup in the Kollmorgen Workbench aids the OEM with a programming methodology engineers know and with which they’re familiar. Fail Safe over EtherCAT (FSoE) combined with the installation of the Safe Encoder in the system’s servomotor save additional time for the OEM during initial machine wiring.

Hansen: While there are several ways technology is helping address the manufacturing labor shortage, most notable to Epicor customers is the way enterprise resource planning or ERP offers automation benefits that allow for continued operational efficiency from the shop floor to the top floor. For example, on the shop floor, software automation can help when connecting machines and automating the information-gathering process. This can improve efficiency — allowing more parts to be made with fewer resources, less machine time, and ultimately less labor.

On the other hand, automation can significantly assist top-floor operations such as onboarding or other tedious necessities that take away from revenue-generating tasks. Refocusing those employees on projects that drive revenue for the company lets that company grow without hiring additional labor.

Miller: Automation will continue to play a key role in solving the growing demand and subsequent shortage of frontline workers in industry — especially as the trend of reshoring manufacturing back to U.S. locations continues to build. At Motion Plus, we manufacture and distribute automation products and solutions that are integrated into machinery used to reduce the burden on manual labor. Whether to maximize productivity for any particular repetitive operation (while also mitigating repetitive strain injuries) or just to optimize a particular process through the precise operation that only a motion control system can provide, it’s truly exciting to be part of the wave of automation driving manufacturing innovation now and into the future.

Read other articles in the Design World Trends series at designworldonline.com/trends.

You may also like:

Filed Under: Trends