Electric motors are at the heart of motion. Across the board, motor manufacturers are seeing increased demand for their products. Hastened by the pandemic, demand in areas such as robotics, autonomous vehicles and automated production and manufacturing lines across a wide swath of industries has risen, spurring new business as well as innovation.

Some top motor suppliers shared with us their insights into the top tech trends driving the motor market, what has shaped their business, and what to expect for 2022 and beyond:

Are there any new applications or markets that have begun employing brushless motors over the last 12 months?

Ametek (Dunkermotoren)

We see a rising demand from the AGV market, the applications are in the wheel and product lift drives. The emerging market of agricultural robots have similar requirements as AGVs of longer life and high torque density in a small package. The future is drives with Ethernet connectivity, cloud connection, and IIoT applications.

Oriental Motor

We’ve seen a rise in brushless motor interest as customers are becoming more aware of the energy efficiency and heat reduction benefits of brushless motors versus ac motors for speed control applications. Some of the new applications we’re seeing increased demand from are modular type conveyors, plant tumblers, and peristaltic pumps. We found that compact motor size, closed-loop speed regulation, quick-connect cabling, and built-in alarms are favorable features for these particular applications.

Any new trends in stepper motors or stepper-based actuation systems? Brush motors? Servo motors?

Ametek (Dunkermotoren)

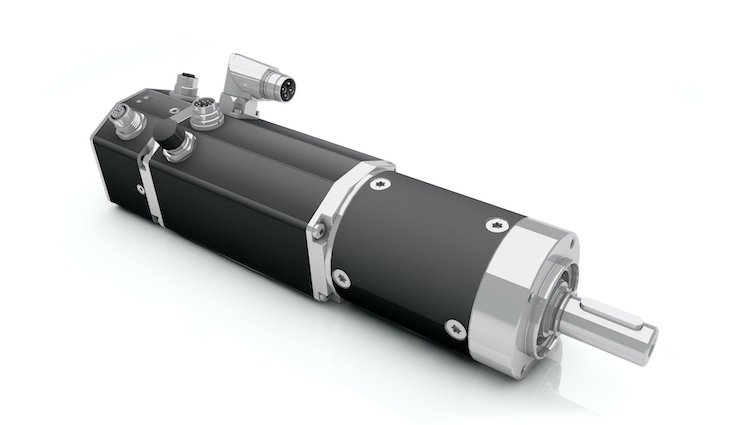

For stepper motors our new portfolio includes gear boxes, encoders, brakes and integrated controllers. For servo and brushless motors, new integrated control functionality such as Ethernet connectivity, STO (Safe Torque Off), SSI-Interface, and Vector Control. Controllers for our brushed DC drives can also deliver all functionality that we offer for our brushless portfolio.

Oriental Motor

Stepper motors have steadily increased their torque output and efficiency over the years and have helped stepper-based actuation systems become smaller, lighter, more powerful, more efficient, and more cost-effective. All of these improvements feed the growing interest for carbon-neutral products that contribute to higher throughput with a smaller footprint.

Are there any trends you are seeing in terms of new materials or sizes to give engineers more design options?

Ametek (Dunkermotoren)

Integral controllers along with our unique firmware and software packages allows for flexibility in designs such as independent motors or master-satellite control styles. Design flexibility is enhanced through our modular platforms, which allows for a wide array of options for design engineers. Our speed to market allows customers to go from a custom design to a market ready production product in a short timeframe.

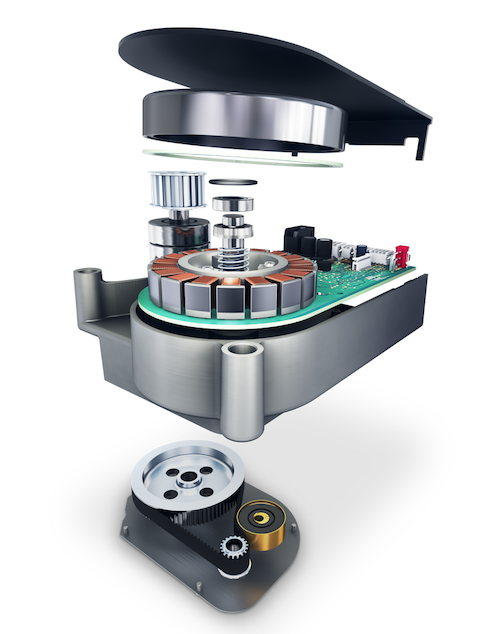

maxon motor

Engineers have the constant need to go smaller while maintaining the same power density. With the technological investments maxon has made in magnet and winding technology we are able to offer high power density products packed full of functionalities while maintaining the smallest footprint possible. Aside from a constant ask for low footprint high power density there has been a trend in most industries to ask component providers if they can do more. Whether it be to add specific connectors and cable lengths to design and assembly complete mechanical subsystems. With more than 80% of our business being modification or custom work, we are positioned well to assist our customers in designing or building sub-assemblies within their own system. By combining our vast modification/customization experience along with our supply chain optimization we can ensure that we are offering our customers various design options that will meet their needs while keeping costs low and power densities high.

Oriental Motor

The need for IP-rated products continues to grow as more of our customers are considering our motors for washdown applications. Size reduction also seems to be a continuing trend for motors and drivers especially when designers have to work around limited space. We continuously perform research and development on various materials and sizes to expand our product breadth. An example is our flat stepper motors, which can fit into thin space.

What role does data play in your product designs? Specifically w/ regard to big data, IoT, Industry 4.0 and beyond, etc.

maxon motor

There is an increased interest for leveraging IoT technologies like networking, cloud computing, signal processing, and data analytics that allows device builders from various industries to broaden their services offering, increase the uptime of their systems and lowering the maintenance cost. The push for more IoT capabilities in system has played a role in our product designs by adding feedback devices such as hall sensors and thermal sensors to our motors offering. There is no doubt that as technology moves forward and IoT becomes more standardized we will have to move towards creating “smart” motors for users to access maintenance data such as wear and tear or configuration data. When it comes to mission critical devices it is important to evaluate these technologies with a strong focus on security and data protection. There is no doubt that we will see an increasing number of features and capabilities that would qualify as IoT capabilities build into new and upcoming devices. But the industry is very aware that any development needs to take security and data protection into consideration. Depending on the type of device, the adoption of IoT capabilities will vary greatly.

Oriental Motor

We’ve noticed a trend of inquiries about data monitoring from motor drivers in the past, and we regularly communicate our market needs to the factory. As a result, we have expanded the product breadth of our AlphaStep AZ Series family to include more built-in industrial communication protocols on drivers such as EtherNet/IP, EtherCAT, and Profinet. We also increased the data that these drivers can collect, so more data can be output to support our customers’ big data operations.

Ametek (Dunkermotoren)

We launched a new brand for serving the demand of IIoT applications to the market in 2021 – Nexofox. There is a future in IoT and Nexofox will help us stay in the forefront of industrial digitization.

Has your company seen increased activity or demand from customers in any specific industries or application areas (robotics, factory automation, off-highway applications, medical, others, etc.)? If so, which ones and to what extent? Explain.

Ametek (Dunkermotoren)

With current labor shortages we are seeing an upward trend in the adoption of self-navigating automation technologies. The applications require long life and high torque from their motors. Medical devices are becoming smaller everyday requiring smaller footprint motors with the same torque output. Agricultural automation is becoming a leading market with the need for robust solutions for harsh outdoor environments.

maxon motor

With the uptick in customization requests designated for various niche industries maxon has continuously analyzed the markets for motion control components and system needs. When a market sector is identified that cannot be covered by our current product offering, we will create targeted solution that will meet and can be easily malleable to any customer’s needs. Some of these examples include the UAV propulsion system, exoskeleton joints, drive wheel assemblies for AGV and even compact drives with integrated electronics designated for the industrial market. It is these targeted solutions that allows the customer to efficiently leverage our engineering resources to get a design idea from the rapid prototyping stage to large scale manufacturing as easily as possible and with minimal customization required.

Oriental Motor

We’ve seen more demand from robotics, automated vehicles, and factory automation applications. Our customers seem to favor our new compact drivers, new industrial communication protocols, and design updates. Also, the semiconductor industry has been booming, and the trend will probably continue for another few years.

With the prospect of supply chain issues staying with us well into 2022, we’ve seen several motion control suppliers giving their customers a heads-up to plan for very long lead times (up to 6 to 12 months for some products!). How do you see customers — especially end users and integrators, who work on more of a project-by-project basis — dealing with the longer lead times and uncertainty in the supply chain?

maxon motor

It is true that the current global situation has affected electronic products in an unanticipated way resulting in a dwindling supply of the electronic components needed. It should also be noted that while the biggest impact has been felt in the motion controllers; the motor assemblies themselves along with sub-system components have also been impacted in one way or another. This has led maxon to establish local suppliers and acquire the knowledge needed to build up an efficient manufacturing process in the states. As of late we are seeing a growing number of our customers use our contract manufacturing service to leverage our design expertise, project management resources and established supply lines to supplement a lack of resources or to reduce their system complexity. It is this contract manufacturing process that our customers leverage to overcome the long lead times seen by many in the industry.

Oriental Motor

Lead time is one of the first questions our customers ask and one of their top filters in vendor selection. To help reduce time-to-market, many of our customers are developing their own automation to complement off-the-shelf automation, and demand for standard products has increased. Standard products offer the shortest lead times as well as guaranteed specifications that complement today’s supply chain environment.

Ametek (Dunkermotoren)

We try to support our customers in finding alternative materials in our products as well in finding different design options like replacing sensor-controlled products by sensor less designs.

Filed Under: Factory automation, Trends, Motion Control Tips